Inflation 2025: What You Need To Know About The Economic Rollercoaster Ahead

Let’s face it, folks—when we talk about inflation 2025, we’re diving headfirst into one of the most critical economic issues that could shape our wallets, investments, and even our lifestyles in the years to come. Inflation isn’t just a buzzword for economists; it’s a reality that affects everyone, from the everyday shopper to the big-time investor. So, buckle up because we’re about to break down what inflation 2025 might mean for you and why you should care.

Now, I know what you’re thinking: “Another article about inflation? Yawn.” But trust me, this isn’t your typical dry, boring economics lecture. We’re going to make it real, relatable, and maybe even a little entertaining. By the time you finish reading, you’ll not only understand what inflation 2025 is all about but also how to protect yourself—or even thrive—amidst the chaos.

So, here’s the deal: inflation 2025 is shaping up to be a pivotal moment in global economics. Whether you’re saving for retirement, planning your next big purchase, or just trying to keep up with rising grocery bills, understanding inflation is key to making smart financial decisions. Let’s dive in, shall we?

Read also:Exploring Jimmy In Yellowstone A Comprehensive Guide

Table of Contents

- What Is Inflation?

- Inflation 2025: The Big Picture

- What Causes Inflation?

- How Does Inflation Impact the Economy?

- Inflation Rate Projections for 2025

- Ways to Protect Yourself from Inflation

- Investment Strategies for Inflation 2025

- Historical Context: Lessons from the Past

- Government Policies to Combat Inflation

- Conclusion: Are You Ready for Inflation 2025?

What Is Inflation?

Alright, let’s start with the basics. Inflation is basically the rate at which the general level of prices for goods and services is rising. Think of it like this: if a loaf of bread costs $2 today and inflation kicks in, next year that same loaf might cost $2.50. It’s not just bread, though; inflation affects everything from gas prices to rent, healthcare, and even your favorite streaming service subscription.

Why Should You Care About Inflation?

Here’s the thing: inflation can silently erode your purchasing power. That means the money you have today might not go as far tomorrow. For example, if your salary doesn’t keep up with inflation, you’re effectively losing money. Ouch, right? Understanding inflation is crucial because it impacts your ability to save, invest, and maintain your standard of living.

Inflation 2025: The Big Picture

Fast forward to 2025, and experts are predicting some pretty significant shifts in the global economy. Inflation 2025 is expected to be influenced by a mix of factors, including post-pandemic recovery, supply chain disruptions, and rising energy costs. But don’t panic just yet—there are steps you can take to prepare yourself.

Key Trends to Watch

- Global supply chains are still recovering from the chaos of 2020-2022.

- Energy prices are expected to remain volatile due to geopolitical tensions.

- Central banks around the world are keeping a close eye on inflation rates.

What Causes Inflation?

Inflation doesn’t just happen out of the blue—it’s usually the result of a combination of factors. Here are some of the main culprits:

1. Demand-Pull Inflation

This happens when demand for goods and services outpaces supply. Think about it: if everyone suddenly wants to buy electric cars, but there aren’t enough to go around, prices are going to go up.

2. Cost-Push Inflation

When the cost of producing goods increases—whether it’s due to higher wages, raw material prices, or transportation costs—those costs get passed on to consumers in the form of higher prices.

Read also:All About Kesha Rose Sebert The Facts The Music And More

3. Monetary Policy

Central banks play a big role in controlling inflation by adjusting interest rates and money supply. If they print too much money or keep interest rates too low, it can lead to inflation.

How Does Inflation Impact the Economy?

Inflation has far-reaching effects that touch every corner of the economy. Here’s how it can impact different sectors:

1. Consumers

For everyday people, inflation means higher prices for everything from groceries to housing. It can also lead to wage stagnation if salaries don’t keep up with rising costs.

2. Businesses

Businesses face increased costs for raw materials, labor, and transportation. This can squeeze profit margins and lead to higher prices for consumers.

3. Investors

Inflation can be both a challenge and an opportunity for investors. On one hand, it erodes the value of cash and fixed-income investments. On the other hand, certain assets like real estate and stocks can act as hedges against inflation.

Inflation Rate Projections for 2025

So, what can we expect in terms of inflation rates by 2025? While it’s impossible to predict the future with 100% accuracy, economists are using historical data and current trends to make some educated guesses.

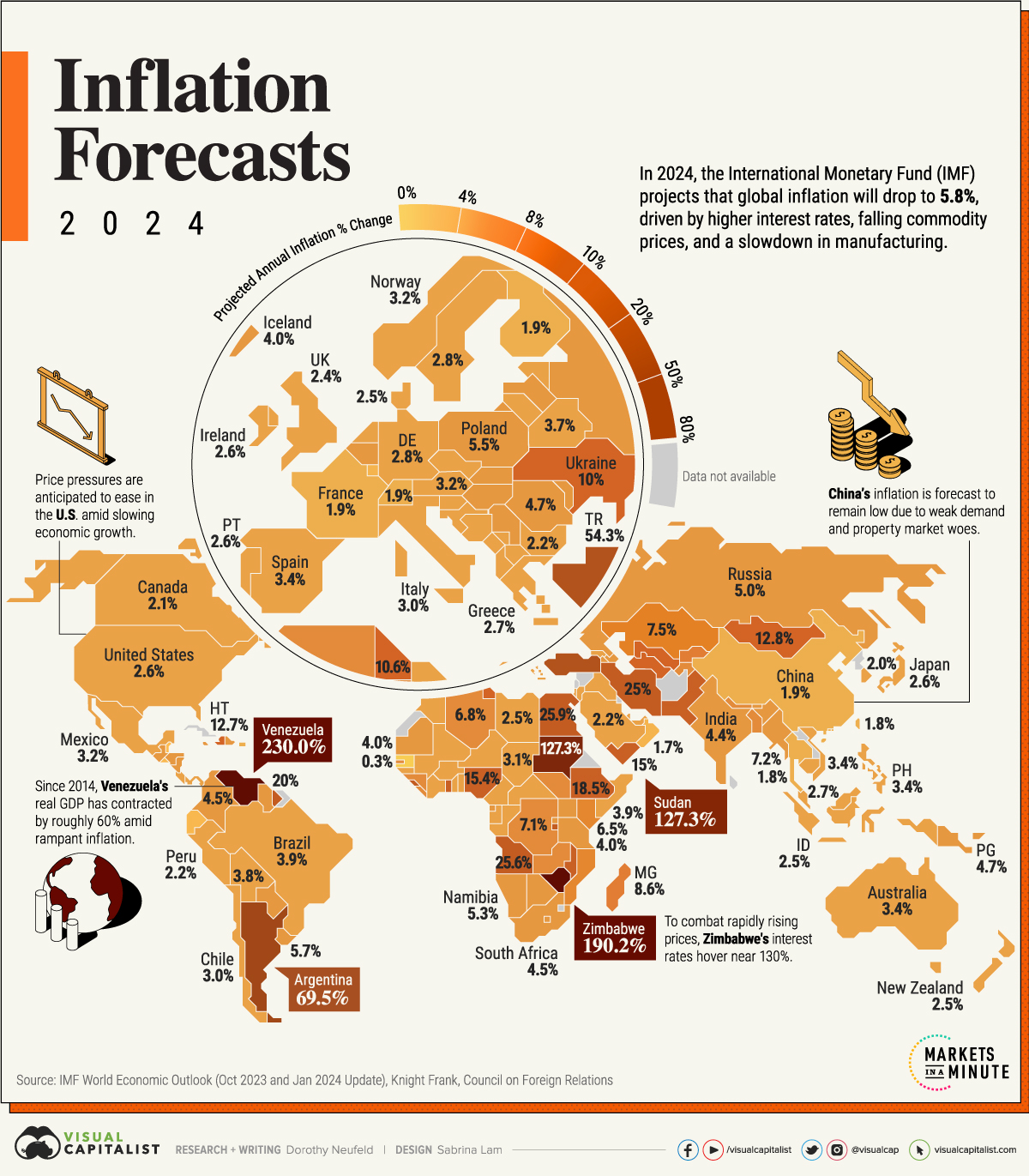

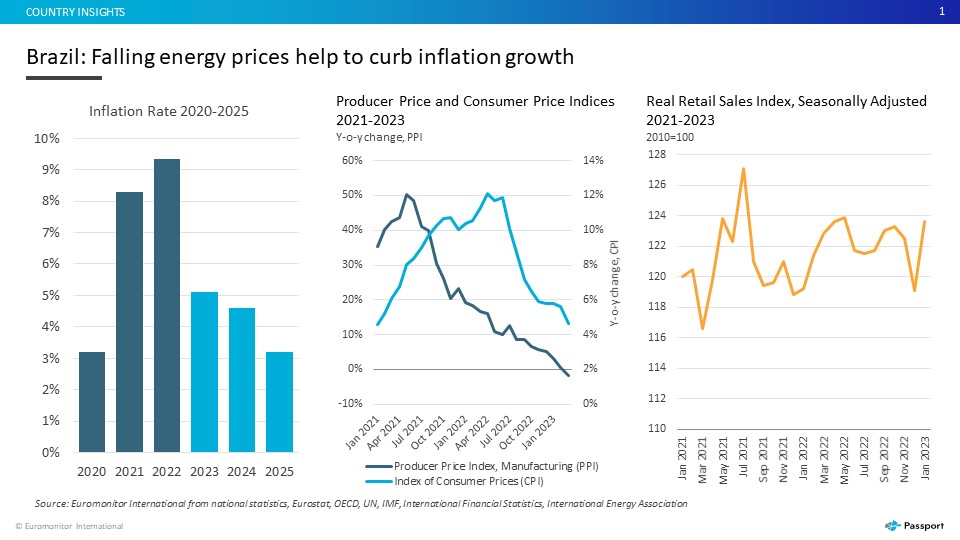

Global Inflation Outlook

According to the International Monetary Fund (IMF), global inflation is expected to moderate slightly in the coming years. However, certain regions—like developing countries with weaker currencies—may still face higher inflation rates.

U.S. Inflation Forecast

In the United States, the Federal Reserve is aiming to keep inflation around 2% annually. However, factors like rising healthcare costs and housing prices could push inflation higher in the short term.

Ways to Protect Yourself from Inflation

Now that you know what inflation is and how it affects the economy, let’s talk about what you can do to protect yourself. Here are a few strategies:

1. Build an Emergency Fund

Having a solid emergency fund can help you weather the storm of rising prices. Aim to save at least 3-6 months’ worth of living expenses.

2. Invest in Inflation-Resistant Assets

Assets like real estate, gold, and commodities tend to hold their value—or even increase in value—during periods of high inflation.

3. Diversify Your Portfolio

Don’t put all your eggs in one basket. A diversified investment portfolio can help mitigate the risks of inflation.

Investment Strategies for Inflation 2025

If you’re looking to grow your wealth despite inflation, here are a few investment strategies to consider:

1. Stocks

Companies with strong pricing power can pass on higher costs to consumers, making their stocks a good hedge against inflation.

2. Real Estate

Real estate tends to appreciate in value during inflationary periods, making it a popular choice for investors.

3. Treasury Inflation-Protected Securities (TIPS)

TIPS are government bonds that adjust their principal value based on inflation, providing a built-in safeguard against rising prices.

Historical Context: Lessons from the Past

To understand where we’re headed, it’s helpful to look at where we’ve been. History is full of examples of inflation—and how economies have responded to it.

1. The 1970s Oil Crisis

Back in the 1970s, skyrocketing oil prices led to rampant inflation. It took years of tight monetary policy to bring inflation under control.

2. Zimbabwe’s Hyperinflation

In the early 2000s, Zimbabwe experienced one of the worst cases of hyperinflation in history, with inflation rates reaching over 79 billion percent. It’s a stark reminder of what can happen when inflation spirals out of control.

Government Policies to Combat Inflation

Governments and central banks have a range of tools at their disposal to fight inflation. Here are a few of the most common strategies:

1. Raising Interest Rates

By increasing interest rates, central banks make borrowing more expensive, which can help slow down economic growth and reduce inflationary pressures.

2. Fiscal Policy

Governments can also use fiscal policy—like reducing spending or increasing taxes—to combat inflation.

3. Supply-Side Reforms

Improving productivity and reducing regulatory barriers can help increase supply, which can help keep prices in check.

Conclusion: Are You Ready for Inflation 2025?

There you have it, folks—a deep dive into the world of inflation 2025. Whether you’re a seasoned investor or just trying to make ends meet, understanding inflation is key to securing your financial future. By staying informed, building an emergency fund, and investing wisely, you can protect yourself from the impacts of inflation—and maybe even come out ahead.

So, what’s next? Take action! Leave a comment below and let us know how you’re preparing for inflation 2025. And don’t forget to share this article with your friends and family—because knowledge is power, and power is priceless.

Until next time, stay sharp and keep your eyes on the prize. Cheers!

Article Recommendations