Ultimate Guide To All State Car Insurance: Benefits, Costs, And Tips You Need To Know

Imagine this—you just got your dream car, but wait… do you really know what’s covered under your All State car insurance? Let’s break it down, shall we? Whether you’re a new driver or a seasoned pro, understanding your policy is crucial. All State car insurance offers some solid benefits, but it’s not all sunshine and rainbows. There are costs, limitations, and tips you need to master before signing on the dotted line.

Let’s face it, car insurance can feel like a maze of fine print and confusing terms. But don’t worry—we’re here to simplify it for you. In this ultimate guide, we’ll dive deep into All State car insurance, covering everything from the benefits to the costs and practical tips that’ll save you time and money. Think of it as your trusty sidekick when navigating the world of insurance.

Now, buckle up because we’re about to take you on a ride through the ins and outs of All State car insurance. From coverage options to discounts, we’ve got you covered. So, whether you’re looking to save a buck or want peace of mind on the road, this guide has got your back. Let’s get started, yeah?

Read also:Discover The Best Tequila Agave El Maguey Unveiled

Table of Contents

- Biography of All State Insurance

- Key Benefits of All State Car Insurance

- Understanding the Costs of Your Policy

- Types of Coverage Available

- How to Get Discounts on All State Car Insurance

- The Claims Process Simplified

- Practical Tips for Policyholders

- Comparing All State with Other Insurers

- Frequently Asked Questions About All State

- Final Thoughts and Next Steps

Biography of All State Insurance

History of All State

All State Insurance Company has been around since 1931, starting as a small division of Sears, Roebuck, and Co. Back in the day, they were all about selling insurance through mail-order catalogs. Fast forward to today, and All State has grown into one of the largest insurance providers in the U.S., offering a wide range of products, including car insurance. But what makes them stand out?

Here’s a quick breakdown:

- Founded: 1931

- Headquarters: Northbrook, Illinois

- Revenue: Over $40 billion annually

- Employees: More than 35,000

Key Benefits of All State Car Insurance

So, why should you choose All State for your car insurance needs? Here are some of the top benefits that make them a popular choice among drivers:

1. Comprehensive Coverage Options

All State offers a variety of coverage options tailored to meet different needs. From basic liability coverage to more comprehensive plans, you can find a policy that fits your lifestyle. Plus, they offer add-ons like roadside assistance and rental car reimbursement, which can be a lifesaver in emergencies.

2. Competitive Pricing

Let’s talk money, shall we? All State is known for offering competitive rates, especially if you bundle multiple policies. Whether you’re insuring your home, car, or life, bundling can save you big bucks in the long run.

3. Excellent Customer Service

According to a recent J.D. Power survey, All State ranks high in customer satisfaction. Their agents are available 24/7 to assist with claims, policy changes, and any questions you might have. Plus, their mobile app makes managing your policy a breeze.

Read also:Sephora In Florence Italy An Indepth Guide To Finding Beauty In The Heart Of Tuscany

Understanding the Costs of Your Policy

Alright, let’s talk turkey. Car insurance ain’t cheap, but there are ways to manage the costs. Here’s what you need to know about pricing with All State:

Factors That Affect Your Premium

Your premium is influenced by several factors, including:

- Your driving record (accidents, tickets, etc.)

- The type of car you drive (sports cars cost more to insure)

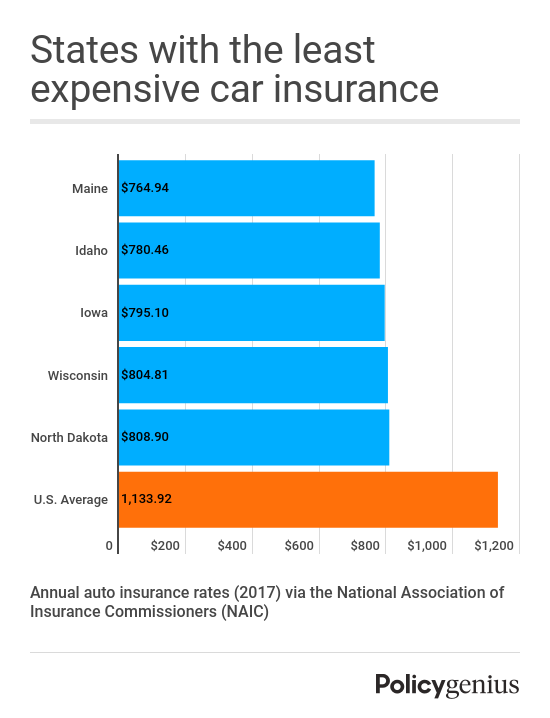

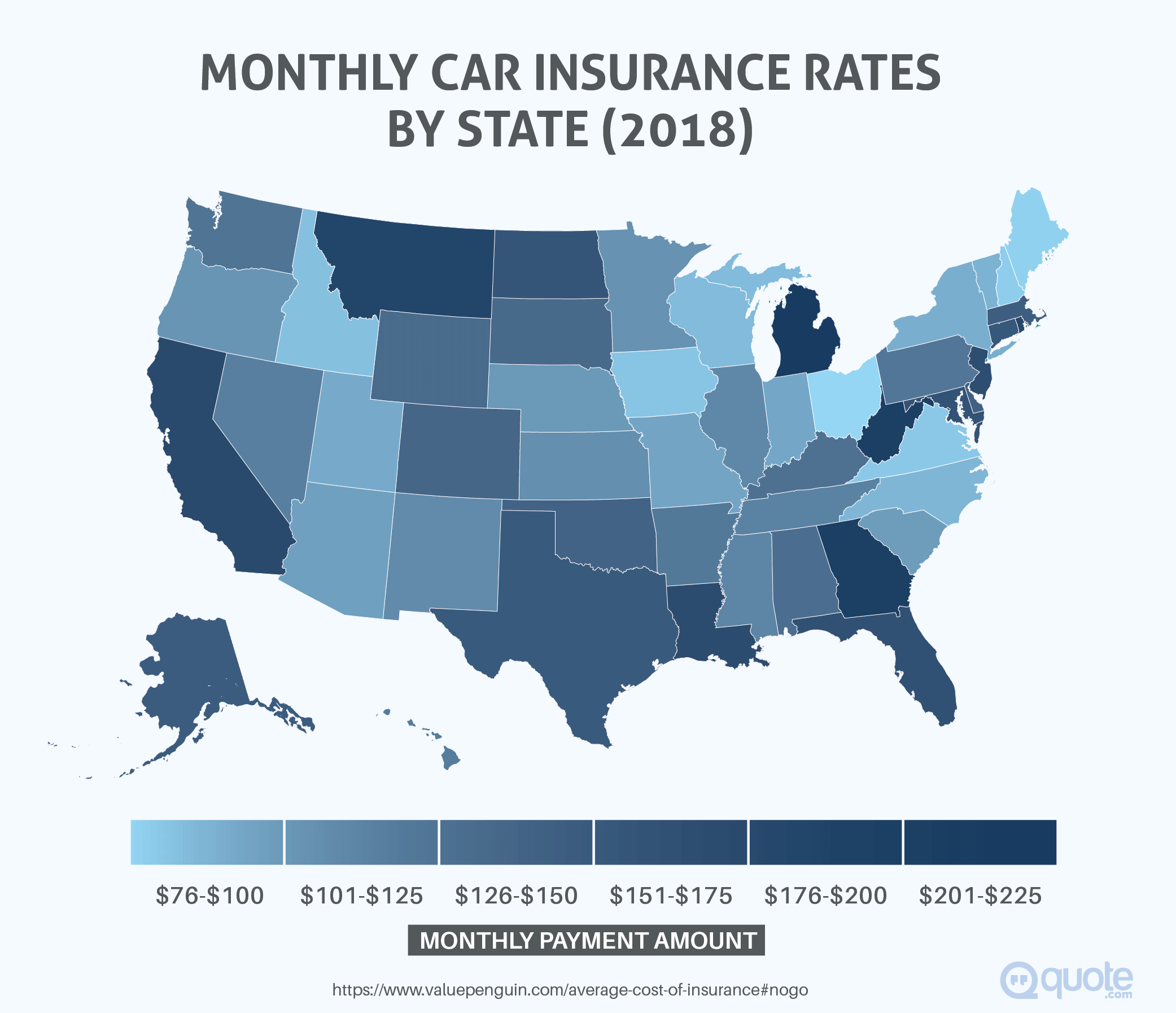

- Where you live (urban areas tend to have higher rates)

- Your age and gender (young drivers, brace yourselves)

It’s important to shop around and compare quotes to ensure you’re getting the best deal. All State offers a free quote process online, so you can see how much you’d pay before committing.

Types of Coverage Available

Now, let’s dive into the nitty-gritty of coverage options. All State offers several types of coverage to protect you and your vehicle:

1. Liability Coverage

This is the bare minimum required by law in most states. Liability coverage pays for damages or injuries you cause to others in an accident. It’s essential, but don’t skimp here—it could save you from financial ruin.

2. Collision Coverage

If you get into an accident and your car is damaged, collision coverage helps pay for repairs. This is especially useful if you’re driving a newer vehicle.

3. Comprehensive Coverage

This covers non-collision incidents like theft, vandalism, or natural disasters. Think of it as an extra layer of protection for your ride.

How to Get Discounts on All State Car Insurance

Who doesn’t love a good discount? All State offers several ways to save on your policy:

1. Safe Driver Discounts

If you’ve got a clean driving record, All State rewards you with discounts. Keep those tickets at bay, folks!

2. Multi-Policy Discounts

Bundling your car insurance with other policies, like homeowners or life insurance, can save you up to 15%. It’s a no-brainer if you’ve got multiple policies.

3. Pay-as-You-Drive Programs

All State’s Drivewise program tracks your driving habits and offers discounts based on safe driving practices. It’s like having a personal coach in your car.

The Claims Process Simplified

Accidents happen, and when they do, you’ll want to file a claim quickly and efficiently. Here’s how the claims process works with All State:

Step 1: Report the Incident

Call All State immediately after an accident or incident. Their agents will guide you through the process and provide you with a claim number.

Step 2: Provide Documentation

You’ll need to submit photos, police reports, and other relevant documents to support your claim. The more evidence you provide, the smoother the process will be.

Step 3: Get Repairs

All State works with a network of approved repair shops to ensure your vehicle is fixed properly. They’ll even help arrange transportation while your car is being repaired.

Practical Tips for Policyholders

Here are some practical tips to help you get the most out of your All State car insurance:

1. Review Your Policy Annually

Things change—your driving habits, your car, your life. Review your policy annually to ensure it still meets your needs.

2. Take Advantage of Discounts

Don’t leave money on the table. Ask your agent about available discounts and make sure you’re getting everything you qualify for.

3. Stay Informed

Knowledge is power. Stay up-to-date on All State’s latest offerings and policy changes to avoid surprises down the road.

Comparing All State with Other Insurers

While All State is a solid choice, it’s always good to compare them with other insurers. Here’s how they stack up:

1. Progressive

Progressive offers similar coverage options and discounts but may have higher premiums for certain drivers. It’s worth comparing quotes to see which company suits you best.

2. Geico

Geico is known for its affordable rates, especially for younger drivers. However, All State’s customer service may edge them out in terms of overall satisfaction.

3. State Farm

State Farm is another big player in the insurance game. They offer competitive rates and a wide range of products, but All State’s tech-savvy approach might appeal more to younger customers.

Frequently Asked Questions About All State

Q: Does All State offer roadside assistance?

A: Yes, All State offers roadside assistance as an add-on to your policy. It covers things like towing, tire changes, and fuel delivery.

Q: Can I bundle my policies with All State?

A: Absolutely! Bundling your car insurance with other policies can save you up to 15% on your premiums.

Q: What happens if I miss a payment?

A: If you miss a payment, All State will notify you and give you a grace period to catch up. If the payment isn’t made, your policy may lapse.

Final Thoughts and Next Steps

There you have it—the ultimate guide to All State car insurance. From benefits to costs and tips, we’ve covered everything you need to know to make an informed decision. Remember, car insurance is an investment in your peace of mind, so choose wisely.

Now, here’s your call to action: take a moment to review your current policy. Are you getting the best deal? Could you benefit from adding more coverage or taking advantage of discounts? Share your thoughts in the comments below or check out our other articles for more tips on saving money and staying safe on the road.

Stay safe out there, and remember—knowledge is your best defense against unexpected surprises. Drive smart, and drive safe!

Article Recommendations