IRS Error Blocks $11k Tax Refund: What You Need To Know

Alright folks, let's talk about something that’s been making waves in the financial world recently. IRS error blocks $11k tax refund, and yeah, you read that right. Imagine this: you’re patiently waiting for your hard-earned money to come back from the IRS, only to find out that some glitch or mistake has stopped it in its tracks. Frustrating, right? But hey, don’t worry—we’re here to break it down for you and help you navigate this tricky situation.

Now, let’s rewind a bit. The Internal Revenue Service (IRS) is supposed to be this super-efficient machine that processes all our tax returns without a hitch. But guess what? Even the IRS isn’t perfect. Sometimes, they mess up big time, and when they do, it can cost taxpayers thousands of dollars. In this case, we’re talking about a whopping $11k refund that got blocked due to an error. Yikes!

So, what’s really going on here? Why does this happen, and more importantly, how can you protect yourself from falling into the same trap? Let’s dive deep into the details and uncover the truth behind IRS errors and how they impact your refunds. Buckle up, because this is gonna be a wild ride!

Read also:Olsen Twins Fashion Lines A Complete Style Evolution You Need To Know

Understanding IRS Errors and Their Impact

First things first, IRS errors are more common than you might think. They can range from simple data entry mistakes to complex system glitches. When these errors occur, they can cause significant delays in processing your tax refund. In some cases, like the one we’re discussing, the error might even block your refund entirely. So, why does this happen?

Well, there are a few reasons. For starters, the IRS handles millions of tax returns every year. With such a massive workload, it’s almost inevitable that some mistakes will slip through the cracks. Add to that the fact that their systems are often outdated, and you’ve got a recipe for disaster. But wait, there’s more!

Common Types of IRS Errors

Let’s take a closer look at some of the most common types of IRS errors that can block your refund:

- Incorrect Social Security Numbers: If the IRS has the wrong SSN on file for you or your dependents, it can lead to a refund delay or block.

- Mismatched Income Information: If the income reported on your tax return doesn’t match what’s on record with the IRS, it can trigger an audit or refund hold.

- Processing Delays: Sometimes, the IRS simply gets backed up, especially during tax season. This can cause delays in processing your refund.

- System Glitches: As we mentioned earlier, the IRS’s systems aren’t exactly cutting-edge. A simple glitch can cause big problems for taxpayers.

Now, you might be wondering, “How do I know if my refund is being blocked by an IRS error?” Great question! Keep reading to find out.

How to Check If Your Refund Is Blocked

Checking the status of your refund is easier than you think. The IRS has a handy tool called “Where’s My Refund?” that allows you to track your refund online. All you need is your Social Security Number, filing status, and the exact amount of your refund. Once you enter this information, the tool will give you an estimated timeline for when you can expect your refund.

But what if you don’t see any updates? That could be a sign that your refund is being held up due to an error. In this case, it’s a good idea to contact the IRS directly. They can provide more detailed information about why your refund is delayed and what steps you need to take to resolve the issue.

Read also:Meet Brad Paisleys Loving Family Wife And Children Revealed

Steps to Take If Your Refund Is Blocked

If you discover that your refund is being blocked due to an IRS error, don’t panic. Here are a few steps you can take to get things back on track:

- Contact the IRS: Reach out to the IRS directly and explain the situation. They may ask for additional documentation or information to help resolve the issue.

- Amend Your Tax Return: If the error is on your end, you may need to file an amended return to correct the mistake.

- Seek Professional Help: If you’re having trouble navigating the IRS system, consider hiring a tax professional to assist you. They can help you untangle the mess and get your refund back on track.

Remember, the key here is to stay calm and take action. The sooner you address the issue, the faster you’ll get your refund.

IRS Error Blocks $11k Tax Refund: Real-Life Examples

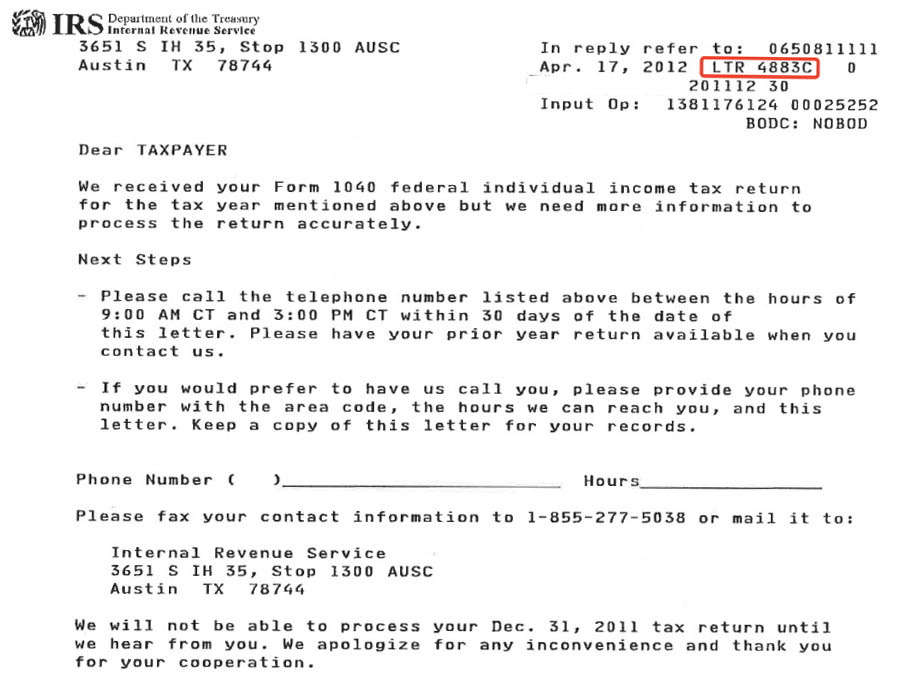

Now, let’s talk about some real-life examples of IRS errors that have caused significant refund blocks. One recent case involved a taxpayer who was expecting a $11,000 refund. Instead, they received a letter from the IRS stating that their refund had been blocked due to a suspected identity theft issue. Can you imagine how frustrating that must have been?

In another case, a family’s refund was delayed because the IRS had the wrong SSN on file for one of their dependents. It took months of back-and-forth communication with the IRS to resolve the issue and get their refund released. These stories highlight just how important it is to double-check your tax return before submitting it and to act quickly if you suspect an error.

Lessons Learned from IRS Errors

From these real-life examples, we can learn a few valuable lessons:

- Double-Check Your Information: Before submitting your tax return, make sure all the information is accurate and up-to-date.

- Monitor Your Refund Status: Use the “Where’s My Refund?” tool to keep an eye on your refund’s progress.

- Act Quickly: If you suspect an error, don’t wait for the IRS to contact you. Take proactive steps to resolve the issue as soon as possible.

By following these tips, you can minimize the risk of falling victim to an IRS error and ensure that your refund gets processed smoothly.

Preventing IRS Errors: Tips and Tricks

While you can’t completely eliminate the risk of IRS errors, there are a few things you can do to reduce the likelihood of them occurring. Here are some tips and tricks to help you prevent IRS errors:

- File Electronically: E-filing is faster and more accurate than filing a paper return. Plus, it allows you to catch errors before submitting your return.

- Use Tax Software: Tax software can help you avoid common mistakes by guiding you through the filing process step-by-step.

- Keep Good Records: Maintain accurate records of your income, deductions, and other financial information. This will make it easier to spot errors and provide documentation if needed.

By taking these precautions, you can increase your chances of getting your refund processed without a hitch.

Understanding Your Rights as a Taxpayer

As a taxpayer, you have certain rights that protect you in the event of an IRS error. These rights are outlined in the Taxpayer Bill of Rights, which includes things like the right to be informed, the right to quality service, and the right to appeal an IRS decision. Knowing your rights can empower you to take action if your refund is blocked due to an error.

For example, if you believe the IRS has made a mistake on your return, you have the right to appeal their decision. This can involve filing a formal protest or requesting a hearing with the IRS Office of Appeals. While the process can be time-consuming, it’s often worth it if it means getting your refund back.

When to Seek Legal Help

In some cases, resolving an IRS error may require legal intervention. If you’ve tried contacting the IRS and amending your return but still haven’t received your refund, it may be time to consult with a tax attorney. They can help you navigate the legal system and ensure that your rights as a taxpayer are protected.

Remember, you don’t have to go through this alone. There are plenty of resources available to help you fight for your refund and hold the IRS accountable for their mistakes.

Final Thoughts: IRS Error Blocks $11k Tax Refund

So, there you have it—the lowdown on IRS errors and how they can block your refund. While it’s frustrating to deal with these issues, the good news is that there are steps you can take to protect yourself and get your refund back on track. By staying informed, monitoring your refund status, and taking proactive measures, you can minimize the impact of IRS errors on your finances.

And remember, if you ever find yourself in a situation where your refund is blocked due to an IRS error, don’t hesitate to reach out for help. Whether it’s contacting the IRS directly, hiring a tax professional, or consulting with a lawyer, there are plenty of options available to help you resolve the issue.

So, what are you waiting for? Take control of your finances today and make sure you’re prepared for any IRS errors that might come your way. Your refund is waiting—go get it!

Table of Contents

- Understanding IRS Errors and Their Impact

- Common Types of IRS Errors

- How to Check If Your Refund Is Blocked

- Steps to Take If Your Refund Is Blocked

- IRS Error Blocks $11k Tax Refund: Real-Life Examples

- Lessons Learned from IRS Errors

- Preventing IRS Errors: Tips and Tricks

- Understanding Your Rights as a Taxpayer

- When to Seek Legal Help

- Final Thoughts: IRS Error Blocks $11k Tax Refund

Article Recommendations