How To Buy Tesla Stock: A Beginner’s Guide To Investing In The Electric Vehicle Giant

Investing in Tesla stock is a decision that can be both exciting and overwhelming, especially if you're new to the world of stocks. The company has become a global phenomenon, and its shares are among the most sought-after in the market. If you’re wondering how to buy Tesla stock, you’ve come to the right place. In this article, we’ll break it down step by step, ensuring you have all the information you need to make an informed decision.

Buying Tesla stock isn’t as complicated as it might seem, but it does require some understanding of the stock market and the company itself. Whether you’re a seasoned investor or just starting out, this guide will help you navigate the process with ease. So, buckle up because we’re diving into the world of Tesla and its stock market journey.

Before we get into the nitty-gritty, it’s important to understand why Tesla stock has captured the attention of so many investors. The company’s innovation, led by the charismatic Elon Musk, has revolutionized the automotive industry. With Tesla, you’re not just buying a stock; you’re investing in a vision for the future of transportation and energy. Let’s explore how you can become a part of that vision.

Read also:Jackerman Mothers Warmth 3 The Ultimate Comfort Experience You Deserve

Understanding Tesla Stock: What You Need to Know

Tesla stock (ticker symbol TSLA) represents ownership in Tesla, Inc., one of the most influential companies in the tech and automotive sectors. But what exactly does owning Tesla stock mean? Simply put, when you buy Tesla stock, you’re purchasing a small piece of the company. This gives you the potential to benefit from its growth and success.

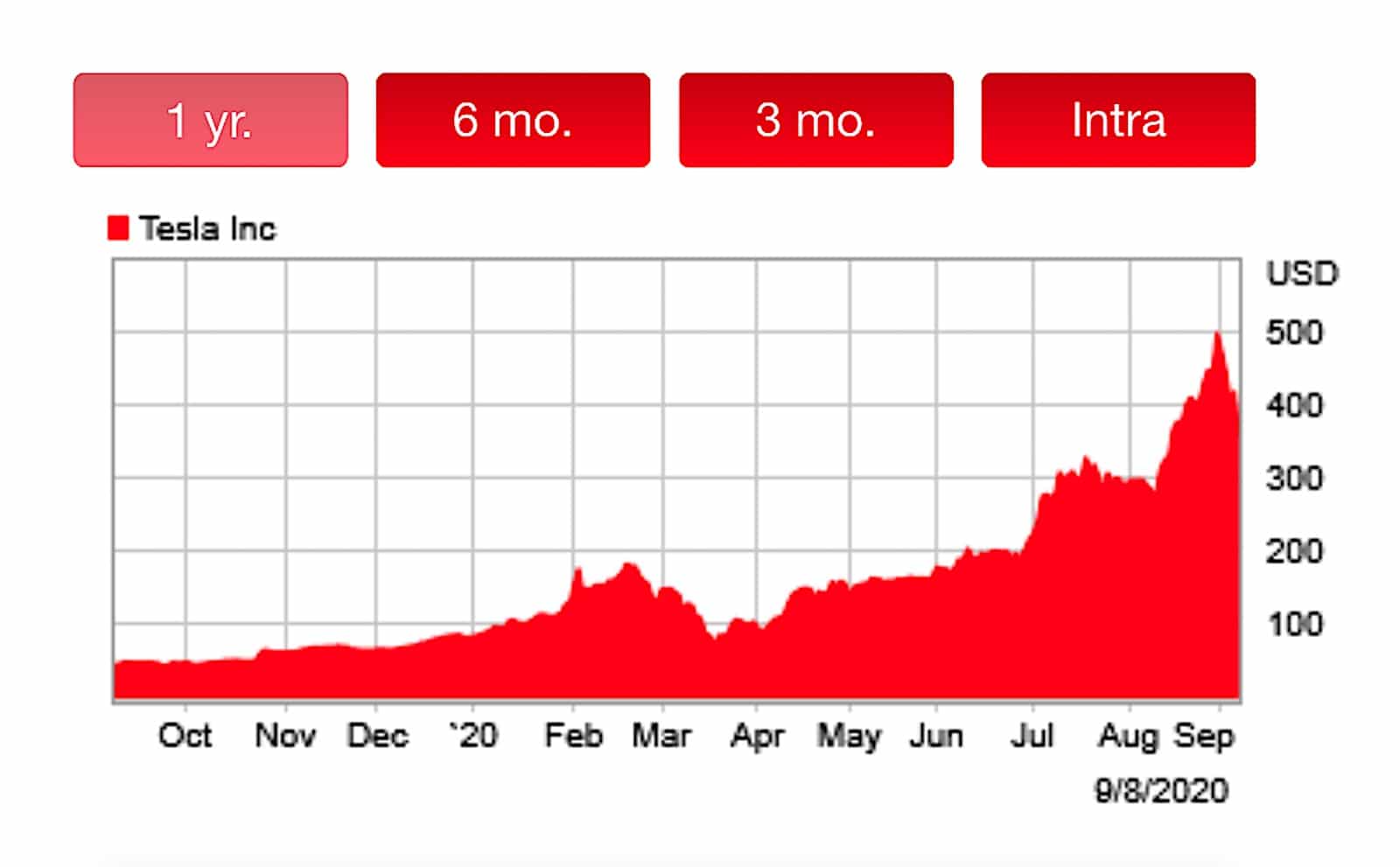

Tesla’s stock has been on a rollercoaster ride over the years, with significant ups and downs. In 2020, the stock split 5-for-1, making it more accessible to retail investors. Since then, it has continued to attract attention from both individual and institutional investors. Understanding the basics of Tesla stock is crucial before you dive in.

Why Tesla Stock is Popular

Tesla’s popularity stems from its groundbreaking innovations in electric vehicles (EVs), renewable energy, and autonomous driving technology. Here are a few reasons why Tesla stock is a hot topic:

- Innovative Products: Tesla is synonymous with cutting-edge EVs like the Model 3, Model S, and Model X. These vehicles have set new standards for performance and sustainability.

- Sustainable Energy: Tesla’s commitment to renewable energy solutions, including solar panels and Powerwall batteries, adds another layer of appeal for eco-conscious investors.

- Elon Musk Factor: The visionary leadership of Elon Musk has turned Tesla into a brand that inspires loyalty and excitement among investors.

Step-by-Step Guide: How to Buy Tesla Stock

Now that you understand the basics, let’s walk through the steps to buy Tesla stock. The process is straightforward, but it’s essential to approach it with care and knowledge.

1. Choose the Right Broker

The first step in buying Tesla stock is selecting a reliable brokerage platform. There are many options available, ranging from traditional brokers to online platforms. Some popular choices include:

- Robinhood

- Charles Schwab

- E*TRADE

- Interactive Brokers

Each broker offers different features, fees, and user experiences, so it’s important to research and choose one that aligns with your investment goals. For example, if you’re looking for a commission-free trading experience, Robinhood might be a good option. However, if you prefer more advanced tools and resources, a platform like E*TRADE could be better suited for you.

Read also:Who Is Patrick Mahomes Father And What Makes Him Stand Out

2. Open a Brokerage Account

Once you’ve chosen a broker, the next step is to open a brokerage account. This usually involves providing personal information, such as your Social Security number, address, and employment details. The account opening process is typically quick and can often be completed online.

Some brokers may require additional documentation, especially if you’re opening a margin account or a retirement account like an IRA. Be sure to have all necessary documents ready to avoid delays.

3. Fund Your Account

After opening your account, you’ll need to fund it before you can start trading. Most brokers allow you to transfer funds via bank transfer, wire transfer, or even a credit card (though this is less common). Make sure to verify the minimum deposit requirements for your chosen broker.

It’s important to only invest money that you can afford to lose. Stock market investments carry risks, and it’s crucial to approach them with a clear understanding of your financial situation.

4. Place Your Order

With your account funded, you’re ready to buy Tesla stock. Log in to your brokerage account and search for TSLA in the trading platform. You’ll see the current price of Tesla stock, along with other relevant information such as trading volume and market capitalization.

When placing your order, you have several options:

- Market Order: This executes your trade at the current market price. It’s quick but may not guarantee the exact price you see.

- Limit Order: This allows you to set a maximum price you’re willing to pay per share. The trade will only execute if the stock reaches your specified price.

- Stop-Loss Order: This helps protect your investment by automatically selling your shares if the price drops below a certain level.

Factors to Consider Before Buying Tesla Stock

Investing in Tesla stock comes with its own set of risks and rewards. Before you make a decision, consider the following factors:

1. Market Volatility

Tesla’s stock is known for its volatility. While this can lead to significant gains, it can also result in substantial losses. Stay informed about market trends and Tesla’s financial performance to make better investment decisions.

2. Company Performance

Keep an eye on Tesla’s quarterly earnings reports, production numbers, and other key metrics. These indicators can provide insight into the company’s health and future prospects.

3. Competition

Tesla operates in a highly competitive industry. Other companies, such as Ford, GM, and startups like Rivian, are also investing heavily in EV technology. Understanding the competitive landscape is crucial for long-term success.

Long-Term vs. Short-Term Investment

Deciding whether to invest in Tesla stock for the short term or the long term depends on your financial goals and risk tolerance. Here’s a breakdown:

1. Long-Term Investment

If you believe in Tesla’s vision and its potential to dominate the EV market, a long-term investment might be the way to go. Historically, companies with strong growth potential have rewarded investors who hold onto their shares for years.

2. Short-Term Investment

For those looking to capitalize on market fluctuations, short-term trading in Tesla stock can be lucrative. However, it requires a keen eye for market trends and a willingness to accept higher risks.

Dividend Policy and Stock Splits

Unlike many traditional companies, Tesla does not pay dividends. Instead, it reinvests its profits into research and development, production, and expansion. This strategy aligns with its focus on growth and innovation.

As mentioned earlier, Tesla has undergone stock splits in the past. These splits make the stock more affordable for retail investors but do not affect the overall value of your investment.

Common Mistakes to Avoid

Investing in Tesla stock can be rewarding, but it’s easy to make mistakes if you’re not careful. Here are some common pitfalls to avoid:

- Chasing Hype: Don’t buy Tesla stock just because it’s popular. Do your research and ensure it aligns with your investment strategy.

- Ignoring Risk: Understand the risks involved in stock market investing and only invest money you can afford to lose.

- Overtrading: Frequent buying and selling can lead to higher fees and lower returns. Stick to a disciplined investment approach.

Conclusion: Is Tesla Stock Right for You?

In conclusion, buying Tesla stock can be a smart move for investors who believe in the company’s mission and potential. However, it’s important to approach this decision with knowledge and caution. By following the steps outlined in this guide and considering the factors discussed, you can make an informed choice about whether Tesla stock is right for you.

We encourage you to share your thoughts and experiences in the comments below. Whether you’re already a Tesla investor or just considering it, your input can help others on their investment journey. And don’t forget to explore our other articles for more insights into the world of finance and investing.

Table of Contents

Here’s a quick reference to all the sections in this article:

- Understanding Tesla Stock: What You Need to Know

- Step-by-Step Guide: How to Buy Tesla Stock

- Factors to Consider Before Buying Tesla Stock

- Long-Term vs. Short-Term Investment

- Dividend Policy and Stock Splits

- Common Mistakes to Avoid

- Conclusion: Is Tesla Stock Right for You?

Remember, investing in Tesla stock is just one piece of the financial puzzle. Stay informed, stay disciplined, and most importantly, stay true to your investment goals. Happy investing!

Article Recommendations

/Tesla Inc logo by- baileystock via iStock.jpg)