Social Security Checks: A Comprehensive Guide You Need To Know

Hey there, friend! Let's dive into the world of social security checks. If you're reading this, chances are you're either curious about how social security checks work or you're looking for answers to some burning questions. Social security checks are more than just a piece of paper with numbers on it—they're a lifeline for millions of people across the United States. So, buckle up as we break it down for you in a way that’s easy to understand and packed with useful info!

Now, before we get into the nitty-gritty, let's clear the air. Social security checks aren't just for retirees. They're also for those who need disability benefits, survivors' benefits, and more. Whether you're nearing retirement or just starting your career, understanding how these checks work can make a huge difference in your financial planning.

So, why should you care? Well, because social security checks are one of the most important safety nets provided by the government. It's not just about receiving money; it's about securing your future and the future of your loved ones. Ready to learn more? Let's get started!

Read also:Who Is Patrick Mahomes Father And What Makes Him Stand Out

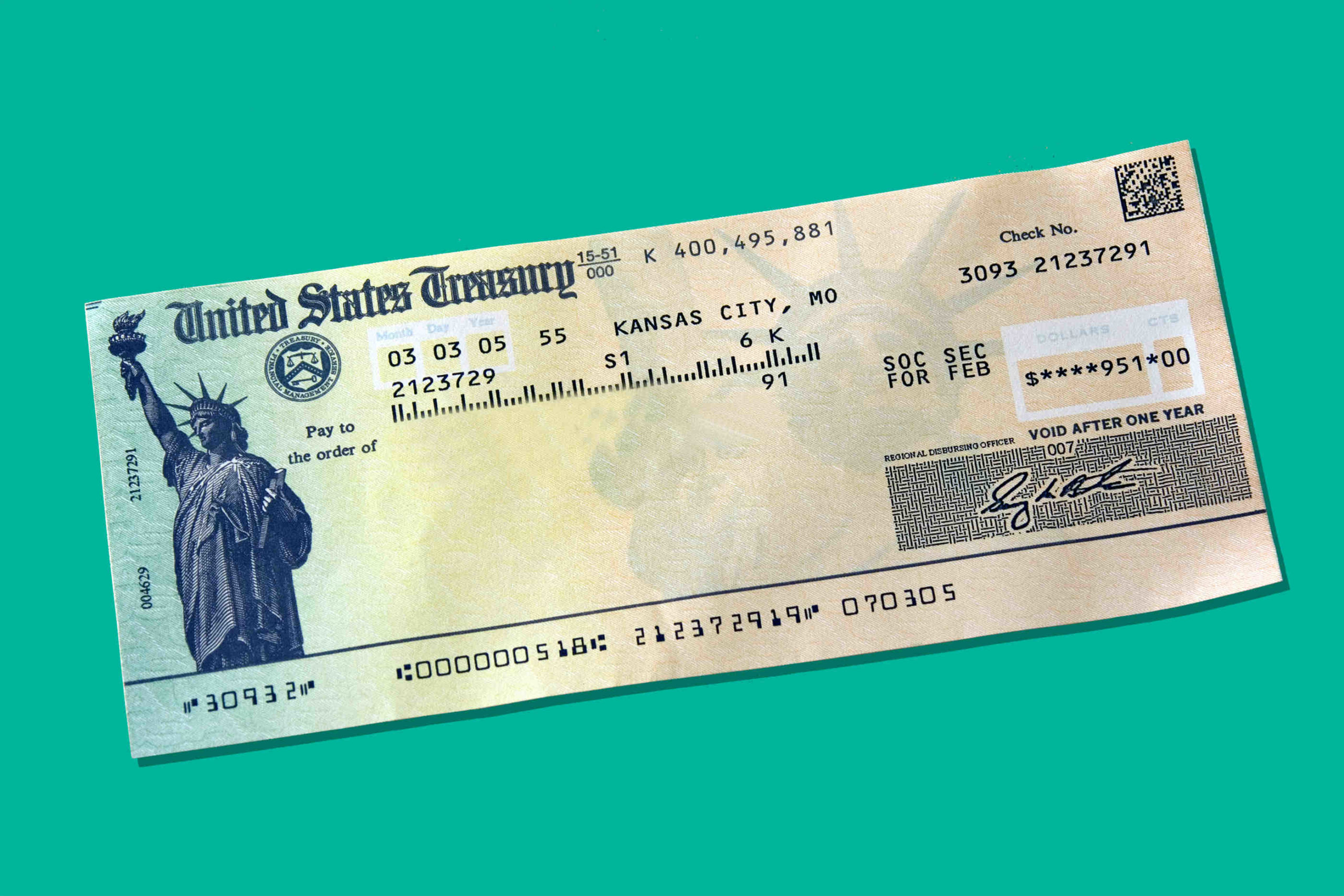

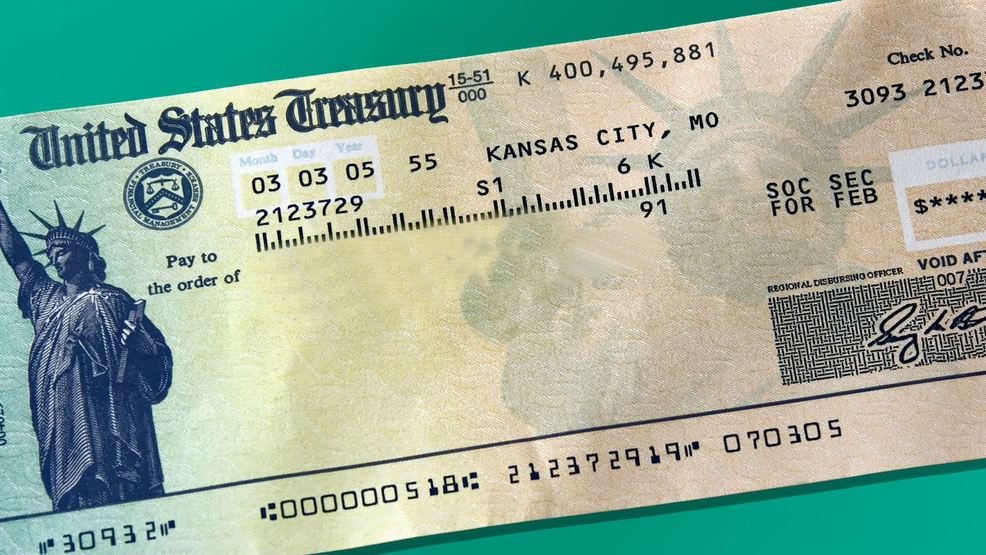

What Are Social Security Checks Anyway?

Alright, let's start with the basics. Social security checks are payments issued by the Social Security Administration (SSA) to eligible individuals. These payments can come in different forms, including retirement benefits, disability benefits, and survivor benefits. Think of it as the government's way of saying, "Hey, we've got your back!"

Key Features of Social Security Checks

Here's a quick rundown of what makes social security checks so important:

- They provide financial support to retirees, disabled individuals, and survivors of deceased workers.

- They're funded through payroll taxes, meaning every working American contributes to the system.

- They're adjusted annually for inflation, ensuring that the purchasing power of the benefits remains stable over time.

So, whether you're planning for retirement or dealing with unexpected circumstances, social security checks can be a crucial part of your financial strategy.

Who Qualifies for Social Security Checks?

Not everyone is eligible for social security checks. There are specific criteria you need to meet, depending on the type of benefit you're applying for. Let's break it down:

Retirement Benefits

To qualify for retirement benefits, you typically need to have worked for at least 10 years and earned a certain number of work credits. The more you've contributed to the system, the higher your monthly benefit will be. It's like a reward for all those years of hard work!

Disability Benefits

For disability benefits, you need to meet the SSA's definition of disability. This usually means you're unable to work due to a medical condition that's expected to last at least a year or result in death. The application process can be a bit tricky, but it's worth it if you qualify.

Read also:Foxy Alex The Rising Star Whos Taking The World By Storm

Survivor Benefits

Survivor benefits are paid to the family members of deceased workers. This includes spouses, children, and sometimes even parents. It's a way to ensure that loved ones are taken care of after the loss of a primary breadwinner.

How Much Can You Expect from Social Security Checks?

The amount you receive in social security checks depends on several factors, including your earnings history and the age at which you start claiming benefits. Let's take a closer look:

Retirement Age Matters

If you claim benefits at your full retirement age (which varies depending on your birth year), you'll receive the full amount you're entitled to. However, if you claim early, your benefits will be reduced. On the flip side, if you wait until after your full retirement age, you can receive even more money each month.

Average Benefit Amounts

As of 2023, the average monthly retirement benefit is around $1,600. For disability benefits, the average is slightly lower, at about $1,300 per month. Keep in mind that these numbers can vary widely depending on your individual circumstances.

How to Apply for Social Security Checks

Applying for social security checks is easier than you might think. You can do it online, over the phone, or in person at your local SSA office. Here's what you need to know:

Documents You'll Need

- Proof of age (birth certificate)

- Social Security number

- Proof of U.S. citizenship or lawful alien status

- Work history and W-2 forms

Having all your documents ready will make the application process smoother and faster.

Common Misconceptions About Social Security Checks

There are a lot of myths floating around about social security checks. Let's debunk a few of them:

Myth 1: Social Security Is Going Broke

While the trust fund that supports social security is projected to run out by 2033, it doesn't mean the program will disappear. Even if the trust fund is depleted, payroll taxes will still cover about 75% of scheduled benefits.

Myth 2: You Should Always Claim Benefits at 62

Claiming early might seem like a good idea, but it can significantly reduce your monthly benefit. Waiting until your full retirement age or beyond can result in higher payments, which could be worth the wait.

Tips for Maximizing Your Social Security Checks

Want to get the most out of your social security checks? Here are a few tips:

Delay Your Claim

As we mentioned earlier, waiting to claim your benefits can increase your monthly payment. It's like getting a bonus for being patient!

Work Longer

Continuing to work past your retirement age can boost your benefits. The SSA recalculates your earnings each year, so if you earn more, your benefit amount could increase.

Coordinate with Your Spouse

If you're married, you and your spouse can strategize to maximize your combined benefits. For example, one of you might claim benefits early while the other waits to claim larger payments later.

How Social Security Checks Impact Your Taxes

Did you know that your social security checks might be taxable? It all depends on your income level. Here's how it works:

Single Filers

If your combined income (adjusted gross income + nontaxable interest + half of your social security benefits) is between $25,000 and $34,000, up to 50% of your benefits may be taxable. If it's over $34,000, up to 85% may be taxable.

Joint Filers

For married couples filing jointly, the thresholds are higher. If your combined income is between $32,000 and $44,000, up to 50% of your benefits may be taxable. If it's over $44,000, up to 85% may be taxable.

Future of Social Security Checks

With the aging population and changing demographics, the future of social security checks is a hot topic. Here's what experts are saying:

Possible Reforms

Lawmakers are exploring various options to ensure the long-term sustainability of the program. These include increasing the payroll tax rate, raising the retirement age, and adjusting the cost-of-living formula.

What You Can Do

While you can't control policy changes, you can take steps to prepare for the future. This includes saving more for retirement, understanding your benefits, and staying informed about potential reforms.

Conclusion: Taking Action on Social Security Checks

And there you have it—a comprehensive guide to social security checks. From understanding the basics to maximizing your benefits, we hope this article has provided you with the information you need to make informed decisions about your financial future.

Now, here's the deal: social security checks are an important part of your retirement plan, but they're not the only piece of the puzzle. Make sure you're saving enough, investing wisely, and planning for unexpected expenses. And don't forget to share this article with your friends and family—knowledge is power!

So, what are you waiting for? Take action today and secure your future. Whether it's applying for benefits, strategizing with your spouse, or learning more about the program, every step counts. Let's make sure you're ready for whatever life throws your way!

Table of Contents

- Social Security Checks: A Comprehensive Guide You Need to Know

- What Are Social Security Checks Anyway?

- Who Qualifies for Social Security Checks?

- How Much Can You Expect from Social Security Checks?

- How to Apply for Social Security Checks

- Common Misconceptions About Social Security Checks

- Tips for Maximizing Your Social Security Checks

- How Social Security Checks Impact Your Taxes

- Future of Social Security Checks

- Conclusion: Taking Action on Social Security Checks

Article Recommendations