Federal Reserve Interest Rates: The Pulse Of The Economy

Hey there, folks. Ever wondered why the economy feels like a rollercoaster ride? Sometimes it's soaring high, and other times it's crashing down. Well, the Federal Reserve interest rates play a massive role in steering that ride. These rates aren't just numbers on a board; they're like the heartbeat of the financial world. So, buckle up because we're diving deep into the fascinating world of federal reserve interest rates, and trust me, it's gonna be a wild ride.

Now, you might be thinking, "Why should I care about federal reserve interest rates?" Great question, my friend. Whether you're a business owner, a homeowner, or just someone trying to save up for that dream vacation, these rates affect your wallet more than you think. They influence everything from mortgage payments to credit card interest and even the return on your savings. So yeah, they're kind of a big deal.

But don't worry, I've got you covered. In this article, we'll break down what federal reserve interest rates are, how they work, and why they matter to you. We'll also explore the history, trends, and what the future might hold. So, let's get started, shall we?

Read also:Kim Kardashians Journey On The Simple Life A Retrospective Examination

What Are Federal Reserve Interest Rates?

Alright, let's start with the basics. Federal Reserve interest rates, often referred to as the Fed funds rate, are the interest rates that banks charge each other for overnight loans. Yep, banks lend money to each other too, and this rate sets the tone for the entire financial system. Think of it as the benchmark rate that influences all other interest rates in the economy.

Here's the deal: when the Fed raises or lowers these rates, it sends ripples through the economy. Higher rates mean borrowing becomes more expensive, which can slow down spending and investment. On the flip side, lower rates make borrowing cheaper, encouraging people and businesses to spend more. It's like a balancing act to keep the economy stable.

Why Do Federal Reserve Interest Rates Matter?

So, why should you care? Well, these rates impact your daily life in ways you might not even realize. For example, if you have a mortgage, the interest rate on your home loan is tied to the Fed funds rate. When rates go up, so does your monthly payment. And if you're saving money in a bank account, higher rates mean better returns on your savings. Cool, right?

But it's not just about personal finance. Businesses also feel the heat. Higher rates can make it harder for companies to borrow money for expansion or hiring, which can slow down economic growth. Conversely, lower rates can spur business activity, leading to job creation and increased productivity. So, whether you're saving, spending, or investing, the Fed's decisions matter big time.

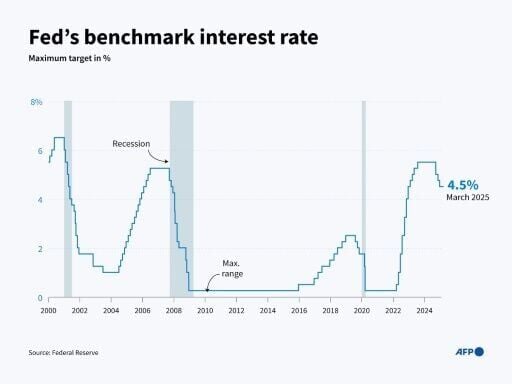

History of Federal Reserve Interest Rates

Let's take a trip down memory lane. The Fed has been tinkering with interest rates since its inception in 1913. Over the years, we've seen some wild swings. Take the 1980s, for example. Inflation was through the roof, and the Fed had to jack up rates to sky-high levels to bring it under control. At one point, rates hit a whopping 20%! Can you imagine paying that on your mortgage?

Fast forward to the 2008 financial crisis, and rates were slashed to near zero to stimulate the economy. It was a desperate move, but it worked. Since then, the Fed has been walking a tightrope, trying to find the perfect balance between stimulating growth and keeping inflation in check. It's been quite the journey, and we're still riding that wave today.

Read also:The Remarkable Journey Of Lil Wayne A Dive Into His Birthdate And Life

How Are Federal Reserve Interest Rates Set?

Now, here's the juicy part. The Fed doesn't just randomly pick a number out of a hat. Nope, it's a well-thought-out process. The Federal Open Market Committee (FOMC) meets eight times a year to discuss economic conditions and decide on interest rates. They look at a ton of data, including inflation, unemployment, and GDP growth, before making their decision.

And here's the kicker: they don't always agree. Sometimes there's heated debate among committee members about the right course of action. But in the end, they come to a consensus, and that decision affects millions of lives. It's like a game of chess, where every move has consequences.

Factors Influencing Rate Decisions

Let's break it down further. Several factors influence the Fed's decision-making process:

- Inflation: If prices are rising too fast, the Fed might hike rates to cool things down.

- Unemployment: High unemployment might prompt the Fed to lower rates to encourage job creation.

- GDP Growth: If the economy is growing too fast, the Fed might raise rates to prevent overheating.

- Global Economic Conditions: What's happening in the rest of the world can also affect the Fed's decisions.

It's a complex web of factors, and the Fed has to weigh them all carefully before making a move.

Impact on the Economy

So, what happens when the Fed tweaks these rates? The effects can be far-reaching. For starters, businesses and consumers adjust their behavior based on the cost of borrowing. If rates are low, people are more likely to take out loans for cars, homes, or business expansion. This boosts economic activity and creates jobs.

On the flip side, higher rates can slow down spending and investment. People might think twice before borrowing money, and businesses might hold off on expansion plans. This can lead to slower economic growth, but it also helps keep inflation in check.

Effects on the Stock Market

And let's not forget the stock market. Traders and investors closely watch the Fed's moves because they can have a big impact on stock prices. Lower rates often lead to higher stock prices because companies can borrow money more cheaply, boosting profits. Conversely, higher rates can lead to lower stock prices as borrowing becomes more expensive.

It's a delicate balance, and the market can be pretty unpredictable. One day it's up, the next day it's down. But one thing's for sure: the Fed's decisions are a key driver of market sentiment.

Current Trends in Federal Reserve Interest Rates

As of now, the Fed is navigating uncharted waters. The global pandemic threw a wrench in the works, and rates were slashed to near zero to support the economy. But with inflation starting to rear its ugly head, there's talk of raising rates again. The big question is: how much and how fast?

Experts are divided. Some argue that rates need to rise quickly to prevent inflation from spiraling out of control. Others believe a gradual approach is better to avoid derailing the recovery. It's a tricky situation, and the Fed has to tread carefully.

Future Outlook

Looking ahead, the Fed faces several challenges. Climate change, technological advancements, and shifting demographics are all factors that could influence future rate decisions. The economy is evolving rapidly, and the Fed needs to adapt to these changes.

One thing's for sure: the next few years will be interesting. Will the Fed succeed in keeping the economy on track? Only time will tell. But one thing's for sure: federal reserve interest rates will continue to be a key player in the financial world.

How Federal Reserve Interest Rates Affect You

Let's bring it back to you, the everyday person. How do these rates affect your life? Well, it depends on your financial situation. If you're a borrower, higher rates mean higher costs. If you're a saver, higher rates mean better returns. It's a double-edged sword, and the impact varies from person to person.

Here are a few ways federal reserve interest rates might affect you:

- Mortgage Rates: If you're buying a home, a change in the Fed funds rate can significantly impact your monthly payment.

- Credit Card Interest: Higher rates mean higher interest charges on your credit card balance.

- Savings Accounts: Higher rates can mean better returns on your savings, which is always a good thing.

So, whether you're saving, spending, or borrowing, the Fed's decisions can have a real impact on your financial well-being.

Expert Insights and Analysis

To get a deeper understanding, let's hear from the experts. Economists and financial analysts closely monitor the Fed's moves and offer their insights on what it all means. Some believe the Fed is doing a great job, while others think they're behind the curve. It's a lively debate, and opinions vary widely.

One thing most experts agree on is the importance of transparency. The Fed needs to clearly communicate its intentions to avoid surprising the market. This helps businesses and consumers plan for the future and make informed decisions.

Key Statistics and Data

Here are some key stats to keep in mind:

- The Fed funds rate is currently at [insert current rate].

- Inflation is running at [insert current inflation rate].

- Unemployment stands at [insert current unemployment rate].

These numbers give us a snapshot of the current economic landscape and help us understand the Fed's decisions.

Conclusion

Well, there you have it, folks. Federal reserve interest rates are a crucial part of the financial system, influencing everything from mortgage payments to stock prices. They're like the conductor of the economic orchestra, keeping everything in harmony. So, whether you're a seasoned investor or just trying to make ends meet, these rates matter to you.

Here's what we've learned:

- Federal reserve interest rates are the benchmark for all other interest rates in the economy.

- They impact everything from mortgage payments to credit card interest and savings returns.

- The Fed carefully considers a wide range of factors before making rate decisions.

- These decisions have far-reaching effects on the economy and your personal finances.

So, what can you do? Stay informed, keep an eye on the Fed's moves, and adjust your financial plans accordingly. And don't forget to share this article with your friends and family. The more we understand these rates, the better we can navigate the financial world. Thanks for reading, and see you in the next one!

Table of Contents

- What Are Federal Reserve Interest Rates?

- Why Do Federal Reserve Interest Rates Matter?

- History of Federal Reserve Interest Rates

- How Are Federal Reserve Interest Rates Set?

- Factors Influencing Rate Decisions

- Impact on the Economy

- Effects on the Stock Market

- Current Trends in Federal Reserve Interest Rates

- Future Outlook

- How Federal Reserve Interest Rates Affect You

Article Recommendations