1400 Stimulus Checks IRS: What You Need To Know Right Now

Listen up, folks! The 1400 stimulus checks IRS has been sending out are a big deal, and if you haven’t caught up on the details yet, you’re in the right place. These payments are part of the government’s effort to help people weather the economic storm caused by the pandemic. Whether you’re waiting for your check or wondering if you’re eligible, this article has got you covered. So grab a coffee, sit back, and let’s dive into the nitty-gritty of what’s going on with these stimulus checks.

Let’s be real here. Money talks, and when the IRS is sending out 1400 bucks to millions of Americans, everyone’s ears perk up. But there’s more to it than just getting a check in the mail or seeing the deposit hit your account. There are rules, qualifications, and even some tricks to make sure you’re getting everything you’re entitled to.

Now, before we jump into the deep end, let’s clear the air. This isn’t just another article filled with jargon and fluff. We’re breaking it down for you, step by step, so you can understand exactly what’s happening with the 1400 stimulus checks IRS is dishing out. Ready? Let’s go.

Read also:Leroy Jethro Gibbs The Unyielding Force Of Ncis

Table of Contents

- The Background Behind the 1400 Stimulus Checks

- Who’s Eligible for the 1400 Stimulus Checks IRS?

- How to Get Your Stimulus Check

- FAQ About 1400 Stimulus Checks

- Timeline for Receiving Your Payment

- Dependents and the 1400 Stimulus Checks

- Tax Implications of the Stimulus Payments

- How the IRS Processes Your Payment

- Troubleshooting Common Issues

- Wrapping It All Up

The Background Behind the 1400 Stimulus Checks

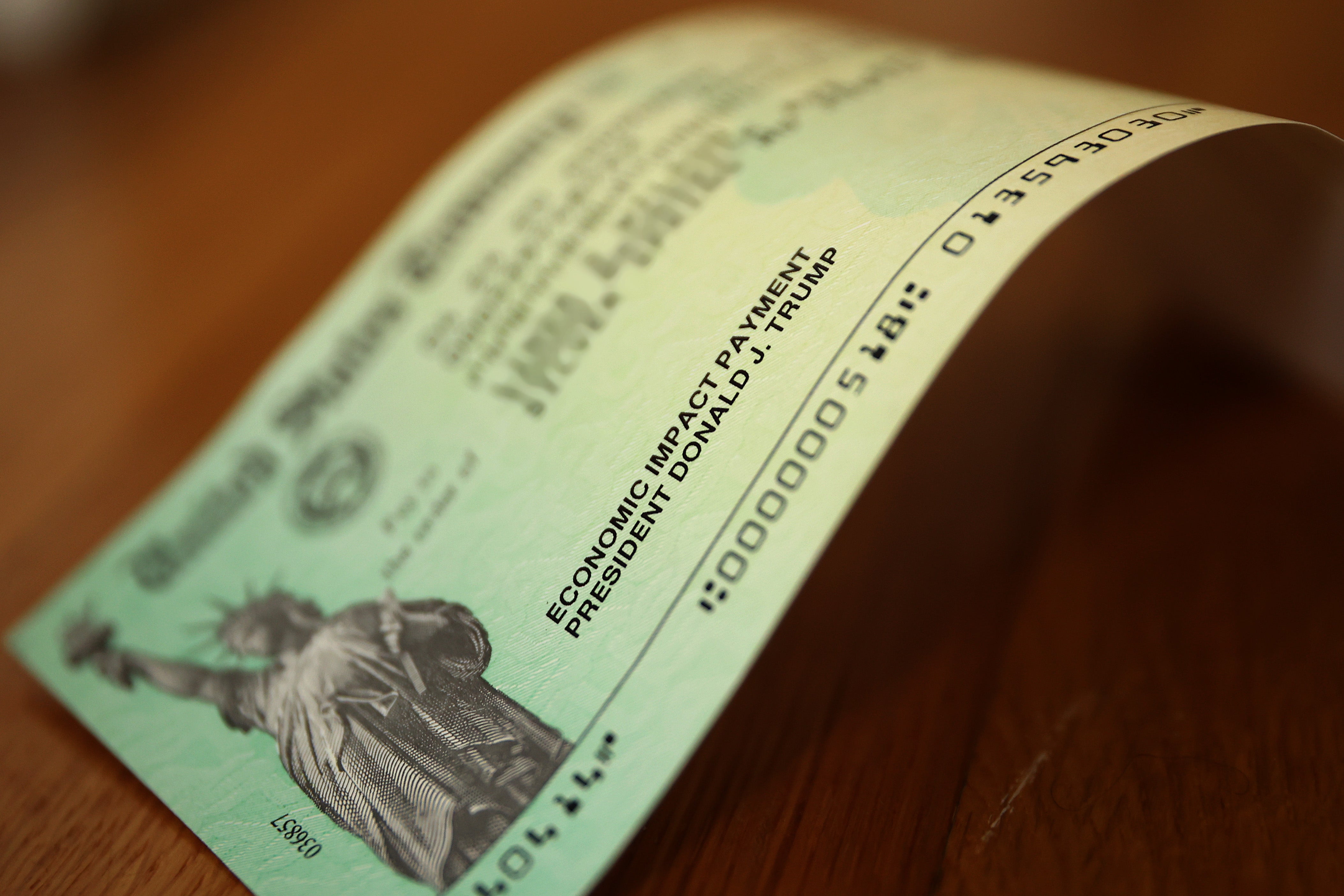

Alright, let’s rewind a bit and talk about how we got here. The 1400 stimulus checks IRS is handing out are part of the American Rescue Plan Act, which was signed into law earlier this year. The goal? To give a financial boost to individuals and families who’ve been hit hard by the pandemic.

These checks aren’t the first round of stimulus payments, but they are the biggest yet. If you got checks in 2020, this one’s a step up. But don’t just take my word for it—according to the IRS, millions of Americans have already received their payments, and more are on the way.

Why This Round is Different

What sets this round apart is the amount—1400 dollars—and the expanded eligibility for dependents. Last time, only kids under 17 counted, but now, older dependents, including college students and adult dependents, can qualify too. That’s a big deal, especially for families who were left out before.

Who’s Eligible for the 1400 Stimulus Checks IRS?

Let’s talk about who gets the green light for these checks. Eligibility is based on your income, filing status, and the number of dependents you claim. Here’s a quick rundown:

- Single filers with an adjusted gross income (AGI) under $75,000 qualify for the full amount.

- Head of household filers with an AGI under $112,500 also get the full payment.

- Married couples filing jointly with an AGI under $150,000 get a combined payment of $2800.

But here’s the catch—if your income is above those thresholds, the payment starts to phase out. And if you’re way above, you might not get anything at all. So, it’s crucial to check where you stand.

Expanded Dependent Rules

One of the coolest things about this round is the expanded rules for dependents. Whether you’ve got a toddler or a 25-year-old in college, they could qualify for an additional 1400 bucks. That’s right—each dependent can bring in extra cash for your household.

Read also:The Inspiring Life Of Aaron Boone The Journey Of A Baseball Legend

How to Get Your Stimulus Check

So, how do you actually get your hands on that sweet 1400 stimulus check? For most people, it’s automatic. The IRS uses the information from your 2019 or 2020 tax returns to determine your eligibility and send the payment. If you’ve already filed your 2020 taxes, that’s the info they’ll use.

But what if you didn’t file taxes last year? No worries. The IRS has a tool called the Non-Filers tool that lets you enter your info and get your payment. It’s super easy, and it could mean the difference between waiting and getting your cash faster.

Direct Deposit vs. Paper Checks

Here’s the deal—direct deposit is the fastest way to get your money. If the IRS has your bank info on file, they’ll send the payment straight to your account. But if they don’t, or if there’s an issue, you might get a paper check or a debit card in the mail. Just keep an eye out for it.

FAQ About 1400 Stimulus Checks

Let’s tackle some of the most common questions people have about these payments:

- What if I didn’t get my check? Double-check the IRS Get My Payment tool to see the status of your payment. If it’s not showing up, you might need to contact the IRS or file a claim.

- Can I get a check if I didn’t file taxes? Yes! Use the Non-Filers tool to enter your info and claim your payment.

- What happens if my income changed since last year? The IRS will use your most recent tax return to determine eligibility, so if your income dropped, you might still qualify.

These are just a few of the questions people have, but there’s plenty more to explore. Keep reading for even more insights.

Timeline for Receiving Your Payment

So, when can you expect your 1400 stimulus check? The IRS has been rolling out payments in waves, so it depends on when they processed your info. If you’re getting a direct deposit, it could hit your account in a matter of days. Paper checks and debit cards might take a bit longer, but they’re on the way.

Tracking Your Payment

The IRS has a nifty tool called Get My Payment that lets you track the status of your stimulus check. Just enter your info, and it’ll tell you when to expect your payment. It’s like a tracking number for your money—pretty cool, right?

Dependents and the 1400 Stimulus Checks

We’ve already talked about how dependents can boost your payment, but let’s dive a little deeper. Whether you’ve got young kids, older kids, or adult dependents, they could all qualify for that extra 1400 bucks. Here’s what you need to know:

- Dependents of any age count this time around.

- You’ll need to claim them on your tax return to get the additional payment.

- Even if they’re not your biological child, as long as they qualify as a dependent, they count.

This is a game-changer for a lot of families, so make sure you’re not leaving money on the table.

Claiming Dependents After the Fact

If you forgot to claim a dependent or didn’t know they qualified, don’t panic. You can still claim them when you file your taxes next year. It might take a little longer to get the money, but it’s worth it in the end.

Tax Implications of the Stimulus Payments

Now, let’s talk about taxes. The good news is that these stimulus payments are not taxable. That’s right—they’re a gift from the government, not a loan. You don’t have to pay them back, and they won’t affect your taxes next year.

Reconciling Payments

However, if you got more or less than you were supposed to, you might need to reconcile it when you file your taxes. Don’t worry—it’s not as scary as it sounds. The IRS will work it out with you, and you won’t owe anything extra unless there’s a major discrepancy.

How the IRS Processes Your Payment

Behind the scenes, the IRS is working overtime to get these payments out. They use your tax return info to determine eligibility and calculate the payment amount. Then, they send it out via direct deposit, paper check, or debit card.

Common Delays

Sometimes, payments get delayed for various reasons. Maybe your bank info is outdated, or there’s a typo in your Social Security number. Whatever the reason, the IRS is working to resolve issues as quickly as possible. If you’re stuck, the Get My Payment tool is your best friend.

Troubleshooting Common Issues

Let’s say you’re having trouble with your stimulus check. What do you do? Here are a few tips:

- Check the IRS Get My Payment tool for updates.

- Make sure your bank info is up to date.

- If you still don’t get your payment, file a claim with the IRS.

Most issues can be resolved pretty easily, so don’t stress too much. The IRS is there to help, even if it takes a little time.

When to Contact the IRS

If you’ve tried everything and still haven’t gotten your payment, it might be time to reach out to the IRS. They have customer service reps who can help you track down your check or resolve any issues. Just be prepared for some wait times—it’s been a busy year for them.

Wrapping It All Up

So, there you have it—the lowdown on the 1400 stimulus checks IRS is sending out. Whether you’re waiting for your payment, trying to figure out eligibility, or just curious about the process, this article should have answered your questions. Remember, these checks are a lifeline for many people, so make sure you’re getting everything you’re entitled to.

Now, here’s the call to action: if you’ve got questions or comments, drop them below. Share this article with your friends and family who might need the info. And if you’re looking for more tips and tricks, check out our other articles. Stay safe, stay informed, and keep those stimulus checks rolling in!

Article Recommendations