Social Security Payments March 26: Your Ultimate Guide To What’s Happening

Alright folks, let’s cut straight to the chase. Social security payments march 26 is something you’ve probably been hearing a lot about lately. Whether you’re a retiree, a disabled individual, or someone who depends on these benefits, this date could mean a lot to you. But here’s the thing—there’s a lot of misinformation out there. So, we’re going to break it down for you, nice and simple, so you know exactly what’s going on.

Now, if you’re like most people, you might be wondering, “What’s the big deal about March 26?” Well, my friend, it’s all about the social security payments that are scheduled to hit your account. For some, this could be the much-needed financial relief they’ve been waiting for. But hold up, there’s more to it than just the money dropping into your account.

In this article, we’re diving deep into everything you need to know about social security payments on March 26. From the types of payments to who’s eligible, we’ve got you covered. So, buckle up and let’s get into it. By the end of this, you’ll be the expert on social security payments and won’t have to second-guess a thing.

Read also:Iconic Films Of James Cagney A Cinematic Retrospective

Understanding Social Security Payments

Before we dive into the nitty-gritty of social security payments march 26, let’s take a step back and understand what social security payments actually are. These payments are a form of government assistance designed to provide financial support to individuals who are retired, disabled, or surviving family members of deceased workers.

Who Qualifies for Social Security Payments?

Not everyone is eligible for social security payments, and that’s an important point to clarify. To qualify, you typically need to have worked a certain number of years and paid into the Social Security system through payroll taxes. Here’s a quick rundown of who usually qualifies:

- Retired workers who are at least 62 years old.

- Disabled individuals who meet the Social Security Administration’s definition of disability.

- Survivors of deceased workers, including spouses and children.

And there you have it, folks. If you fall into any of those categories, then you’re in luck because you might be eligible for some sweet financial assistance.

Why March 26 Matters for Social Security Payments

So, why is March 26 such a big deal when it comes to social security payments? Well, it’s all about timing. The Social Security Administration (SSA) has a schedule for when payments are distributed, and March 26 happens to fall right in the middle of their payment cycle. This means that a lot of people will be receiving their payments on this date.

Payment Schedules and Deadlines

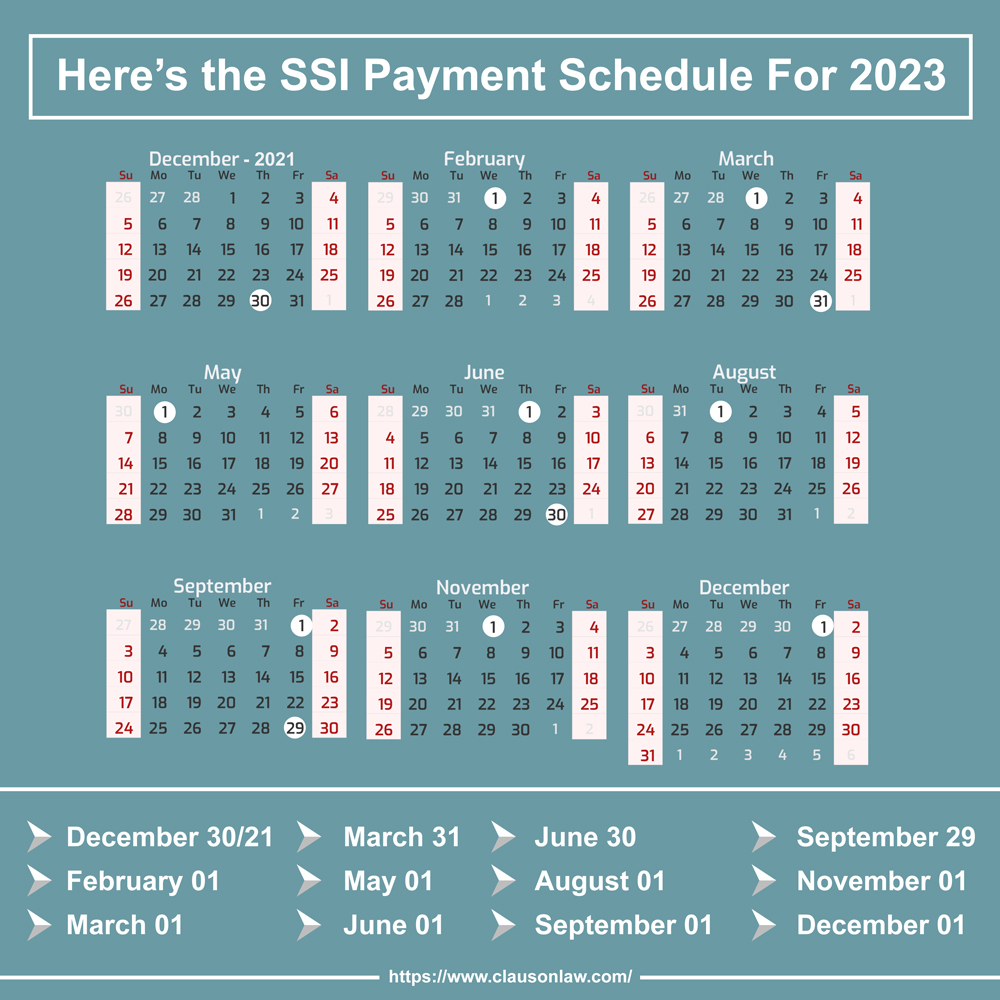

Let’s talk a bit about how the SSA organizes their payment schedules. Payments are usually distributed on specific dates, depending on when you were born. Here’s a quick breakdown:

- If your birthday is between the 1st and 10th of the month, your payment is typically sent on the second Wednesday of the month.

- If your birthday is between the 11th and 20th, your payment is sent on the third Wednesday.

- And if your birthday is between the 21st and the last day of the month, your payment is sent on the fourth Wednesday.

March 26 happens to fall on a Wednesday, which is why so many people are expecting their payments on this date. It’s all about the timing, baby.

Read also:Justin Bieber And P Diddy A Tale Of Stardom And Influence

Types of Social Security Payments

Not all social security payments are created equal. There are different types of payments that the SSA offers, and it’s important to understand the differences. Here’s a quick overview:

Retirement Benefits

Retirement benefits are the most common type of social security payment. These are designed to provide financial support to individuals who have reached retirement age. The amount you receive depends on how much you earned during your working years and how long you’ve been paying into the system.

Disability Benefits

Disability benefits, on the other hand, are for individuals who are unable to work due to a medical condition. To qualify, you must meet the SSA’s strict definition of disability, which means your condition must prevent you from doing any substantial work and is expected to last at least a year or result in death.

Survivor Benefits

Survivor benefits are for family members of deceased workers. This can include spouses, children, and even parents in some cases. The amount of the benefit depends on the earnings record of the deceased worker and the number of survivors.

How Much Can You Expect to Receive?

Now, here’s the million-dollar question—how much can you expect to receive from your social security payments march 26? The answer, my friend, is it depends. The amount you receive is based on a variety of factors, including your work history, how much you’ve paid into the system, and the type of benefit you’re receiving.

Average Payment Amounts

According to the SSA, the average monthly retirement benefit in 2023 is about $1,681. However, this number can vary widely depending on your individual circumstances. For disability benefits, the average monthly payment is around $1,281, while survivor benefits can range from a few hundred to several thousand dollars, depending on the situation.

What Happens If You Don’t Receive Your Payment?

Let’s say March 26 rolls around, and you don’t see your social security payment in your account. What do you do? First of all, don’t panic. There could be a number of reasons why your payment hasn’t been processed yet. Here are a few steps you can take:

- Double-check the payment schedule to make sure you’re looking on the right date.

- Contact the SSA to verify your payment status. They can usually give you more information about what’s going on.

- If you’re still having trouble, consider reaching out to a legal advisor or advocate who specializes in social security issues.

Remember, it’s always better to be proactive and get to the bottom of things sooner rather than later.

Tips for Managing Your Social Security Payments

Now that you know when and how much you can expect to receive from your social security payments march 26, let’s talk about how to manage that money wisely. Here are a few tips to keep in mind:

Set Up Direct Deposit

One of the best things you can do is set up direct deposit for your social security payments. This ensures that your money is deposited directly into your bank account on time, every time, without any hassle.

Create a Budget

It’s always a good idea to create a budget for your social security payments. This will help you plan for your expenses and ensure that you’re not overspending.

Invest in Your Future

If you’re able to, consider putting some of your social security payments into a savings or investment account. This can help you build a financial cushion for the future.

Common Myths About Social Security Payments

There are a lot of myths floating around about social security payments, and it’s important to separate fact from fiction. Here are a few common myths:

- Myth: Social security is going bankrupt. Fact: While the system is facing some financial challenges, it’s not going away anytime soon.

- Myth: You can only receive social security if you’ve worked your entire life. Fact: Many people qualify for benefits based on their spouse’s or parent’s work record.

Don’t fall for these myths, folks. Do your research and stay informed.

Final Thoughts on Social Security Payments March 26

Well, there you have it, folks. Social security payments march 26 is something that could have a big impact on your financial situation. Whether you’re a retiree, a disabled individual, or a survivor, understanding how the system works and what to expect can make all the difference.

So, what’s the next step? Make sure you’re aware of the payment schedule, set up direct deposit if you haven’t already, and start planning how you’ll use your benefits. And if you have any questions or concerns, don’t hesitate to reach out to the SSA or a trusted advisor.

Call to Action

Now it’s your turn. Did you find this article helpful? Do you have any questions or comments about social security payments march 26? Leave a comment below and let’s keep the conversation going. And don’t forget to share this article with your friends and family who might find it useful. Together, we can make sure everyone is informed and prepared.

Table of Contents

- Social Security Payments March 26: Your Ultimate Guide to What’s Happening

- Understanding Social Security Payments

- Who Qualifies for Social Security Payments?

- Why March 26 Matters for Social Security Payments

- Payment Schedules and Deadlines

- Types of Social Security Payments

- Retirement Benefits

- Disability Benefits

- Survivor Benefits

- How Much Can You Expect to Receive?

- Average Payment Amounts

- What Happens If You Don’t Receive Your Payment?

- Tips for Managing Your Social Security Payments

- Set Up Direct Deposit

- Create a Budget

- Invest in Your Future

- Common Myths About Social Security Payments

- Final Thoughts on Social Security Payments March 26

- Call to Action

Article Recommendations

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/DXECHX4MWVGHNK427QRIUWW3VE.jpg)